AS THE NATION’S LARGEST ERTC COMPANY, WE’RE ON A MISSION:

Maximize Your Refund. Minimize Your Risk.

We Hold Your Hand Through The Complex ERTC Process To Get The Funding You Deserve.

Get Up To $21,000 Per Employee

DON'T DELAY! YOU NEED TO HAVE YOUR FILE IN BY MARCH 31ST, 2025 TO ALLOW TIME TO PROCESS AND MEET THE FILING DEADLINE OF APRIL 15TH!

DAYS

HOURS

MINUTES

SECONDS

Don't be left out...

75% of businesses we’ve successfully gotten millions in funding for had no idea they were qualified to receive it.

That’s What We’re Here To Solve. You’re In The Right Place

We help business owners navigate the complex filing process to receive the largest eligible rebate amount for you from the Employee Retention Tax Credit Program, so you can…

BUILD. GROW. SCALE.

Our team of experts is here to do everything in our power to help you further your future.

So No Matter

Your State

No Matter Your Industry

Whether You Have 1 Employee or 500

If COVID affected your business in big ways or small,

We're going to get you the maximum ERTC rebate you are eligible for before its too late...

Ready to put our expertise to work for your business? Secure your future now.

DO I QUALIFY?

Our team of experts fully understand specific qualification requirements needed to obtain and maximize your ERTC Advance funding.

Your business or tax-exempt entity can qualify if you’ve experienced...

Don’t Let Misconceptions Hold You Back

from Claiming Your ERTC Credit.

The ERTC tax incentive is heavily under utilized due to misconceptions about eligibility.

If one of the objections below is holding you back from applying, we still want to hear from you!

Don’t miss out! You may be eligible to receive thousands if not millions in funding for your business. We’re the experts in that, so let us help you get there.

“We never shut down our business.”

Revenue is just one of many factors that determine whether you qualify for ERTC. In fact, companies without a considerable revenue decline and even increases in revenue can still qualify for the employee retention tax credit.

“Our business is not essential.”

Your business does not have to be deemed “essential” to qualify for employee retention tax credit. If you own a small business, any small business, it’s worth applying with us.

“We have received a Paycheck Protection Program loan before.”

That’s great! AND…Companies that have received one or both PPP fundings are STILL eligible for the employee retention tax credit. We know how to file to get you the funding you deserve.

“We never shut down our business.”

The ERTC tax incentive has several provisions that make it possible for employers who were not forced to completely shut down their business to STILL qualify for the ERTC. Businesses that were forced to partially shut down their business can make a claim. Additionally, businesses without a government mandate to shut down or partially shut down their business can still qualify through revenue decline. It’s a complicated process, but we can help you find out if you qualify if you’re still unsure.

“Our revenue went up after a shift in the market.”

Congrats! Although your revenue may have increased overall for the year, many companies experienced declines in one or more quarters in 2020 and/or 2021 when compared to 2019. These short-term revenue declines allow you to qualify, even with increased annual revenues.

“My business is too new.”

No such thing. Startups & new businesses are NOT left behind. As a measure to make the ERTC more inclusive, the ERTC program eligibility criteria were expanded to accommodate new businesses established after February 15th, 2020 with gross yearly revenue below $1 million. Meeting these criteria will enable Startups to qualify for up to $7,000 per employee, to a maximum rebate of $50,000 in Quarter 3 of 2021, and Quarter 4 of 2021.

“It’s too late to apply for the ERTC.”

You still have time! If eligible, employers can claim the ERTC for qualified wages paid in 2020, as well as Q1, Q2, and Q3 of 2021.

Startups & New Businesses are NOT left behind.

As a measure to make the ERTC more inclusive, the ERTC program eligibility criteria were expanded to accommodate Startups:

Meeting these criteria will enable Startups to qualify for up to $7,000 per employee to a maximum rebate of $50,000, in Quarter 3 2021, and Quarter 4 of 2021.

Real American CPAs

The ERTC program requires complex accounting. That’s why our staff of licensed American CPAs who specialize in complex ERTC filings rather than cheap offshore labor.

Audit Defense

No guessing. We do a full blown assessment. That way, if you’re ever audited by the IRS, our Sleep Well Guarantee will give you the verified proof needed to protect you and defend your full refund claim.

Transparent Pricing

With ERTC Express, there are never hidden costs or upfront fees. You’ll know exactly what you will pay and you only pay us when you get paid. We only succeed when you succeed.

Humans Who Care

No automated software is used to process and file your refund. Instead, we have professional CPAs, attorneys, and customer service agents you can speak to at any time

Maximize Your Refund

We make sure you get the refund you deserve. Our team of ERTC specialists will identify the best possible ways to maximize your ERTC refund. On average, our refunds are 40-120% higher than those of large payroll & software companies.

The Power of Three: 3 CPA’s for Ultimate Accuracy

With most other companies, you’re lucky if you have even ONE CPA process your claim. “The Power of Three” is our accounting process to provide bulletproof ERTC filings by having 3 different CPA teams cross-check your final refund amount before submitting your claim.

Get Funding Advances

The accuracy of our claims process and industry acceptance of its reliability have enabled many clients to gain access to funding advances for their ERTC claims.

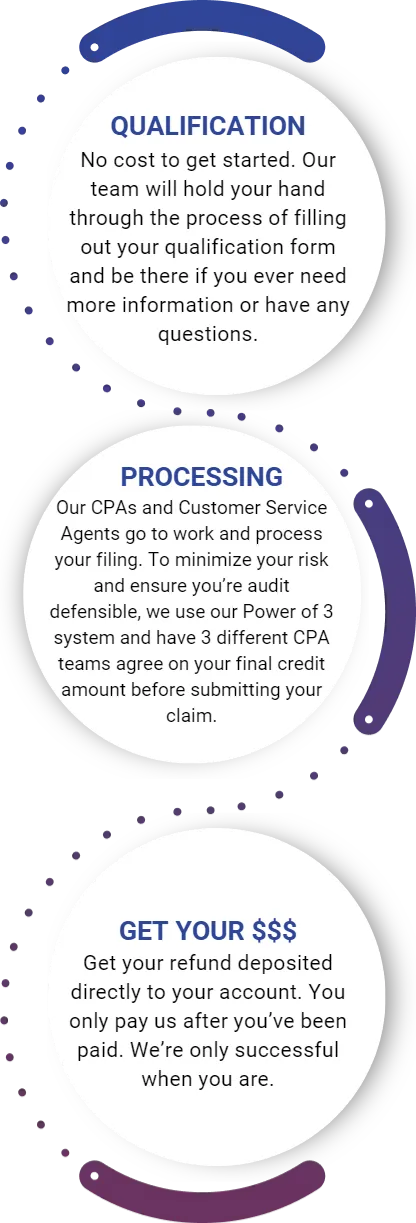

QUALIFICATION

No cost to get started. Our team will hold your hand through the process of filling out your qualification form and be there if you ever need more information or have any questions.

PROCESSING

Our CPAs and Customer Service Agents go to work and process your filing. To minimize your risk and ensure you’re audit defensible, we use our Power of 3 system and have 3 different CPA teams agree on your final credit amount before submitting your claim.

GET YOUR $$$

Get your refund deposited directly to your account. You only pay us after you’ve been paid. We’re only successful when you are.

SECURE THE FUTURE OF YOUR BUSINESS.

SECURE THE FUTURE OF YOUR BUSINESS.

GOT QUESTIONS?

We’ve got answers. Take a look at the answers to the our most frequently received questions about the ERTC program.

Can I Receive ERTC Funds For Q4 2021?

There is a program for new start-up businesses who began operations after Feb 15th, 2020 that allows these businesses to claim Q4 2021. However, most businesses will not qualify in Q4 2021. No……but hope is not lost. There is a movement by politicians to include Q4 2021 but currently, wages paid after September 30, 2021, are no longer considered eligible wages for ERTC purposes. As of right now, if you paid employee wages prior to September 30, 2021, we encourage you to apply now.

GET YOUR REFUND ESTIMATE IN 4 MINUTES OR LESS

Complete Our Form Below to See if You Qualify To Get The Funding You Deserve.

Up to $21,000 per employee.

By submitting this form, I authorize ERTC Express to contact me by phone, text, and email via automated technology.

Calls may be recorded for training purposes.

Questions? Contact Us Today!

Guy Bergstrom, ERTC Express Agent

PHONE: (763) 682-4362

EMAIL: [email protected]